RBI issued the first master circular on Paytm KYC in October 2017 but the same was amended on February 28th, 2018. The new directives propose that all the new users are supposed to get their KYC done while signing up. For the masses, this is in fact a good step to get rid of money laundering, theft and fraud charges. These steps will go a long way in making the entire financial system safer.

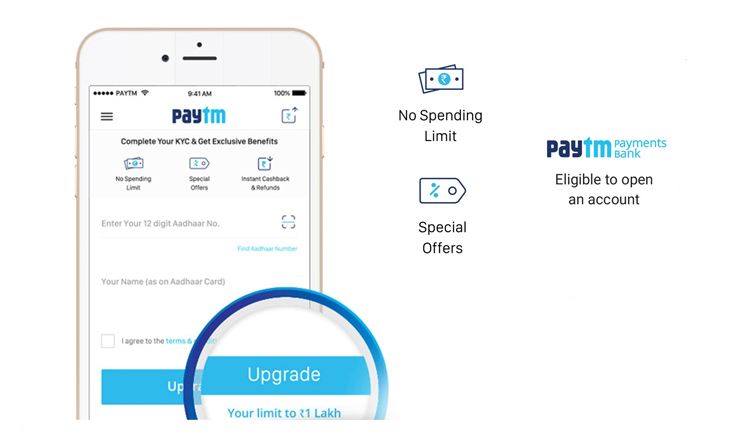

Customers are supposed to provide their original Aadhar number, PAN details before using their accounts. The process is secure, innocuous and easy. Let us check a few benefits of getting the KYC done for the Paytm users:

Impeccable transfer of funds: If you are into any sorts of business and transferring funds every now and then, as per the latest guidelines issued by RBI, users without updated KYC will not be able to transfer funds to their own accounts or anyone else’s.

Paytm payments bank:You must know that Paytm payments bank includes the benefits of zero digital transaction charges, zero minimum balance, digital passbook, free virtual debit card and many more.

High wallet edge: If you are a full KYC verified Paytm user then you are free to enjoy the wallet balance of Rs. 1 lakh maximum along with unlimited access to monthly expenditure. Minimum KYC verified operators will be having both the balance limit and monthly expense limit of only Rs. 10, 000.

বাংলায় পড়ুন

বাংলায় পড়ুন